SEC Climate Rule: Scenario Analysis - Part 3

SEC Climate Rule: Scenario Analysis - Part 3

This post is the third in a series to do with scenario analysis and the proposed SEC Climate-disclosure rule. The background to the series is explained in the first post: SEC Climate Rule: Scenario Analysis - Part 1.

Scenario Analysis

We started the series of posts with an evaluation of the relevant sections of the proposed rule. We quote the wording of the rule using the page numbers in the SEC’s document (The Enhancement and Standardization of Climate-Related Disclosures for Investors). The first two posts reviewed material on pages 83 and 84. We continue the evaluation by considering material on pages 84 to 86.

Commentary

The wording of the rule is shown in bold/italic text. Commentary is shown in plain text.

Page 84

One commenter stated that scenario analysis was useful because it allows companies to test their business strategy against a spectrum of hypothetical future climate scenarios and develop a better informed view of implications for their enterprise value and value chains.

This commenter understands the climate change is just one piece of a much larger and more complex system.

Page 85

The TCFD’s most recent assessment of public companies’ voluntary climate reporting similarly found that only a small percentage of the surveyed companies disclosed the resilience of their strategies using scenario analysis as recommended by the TCFD.

A key justification for this rule is that most companies do not issue climate reports on a voluntary basis. Even those that do prepare reports do not necessarily share them with the public.

The TCFD recommendations will be discussed in a future post. They form the basis of much of what the SEC is proposing in this new rule.

Pages 85-86

Other commenters stated that they opposed a scenario analysis requirement because of the lack of a common methodology for scenario analysis; a belief that the underlying methodology would be too difficult for investors to understand; the need for further development of scenario analysis as a discipline; or a belief that the focus of climate-related disclosure should be on historical data, and not on forward-looking information.

The lack of a common methodology is critical. This is not a reason to oppose the analysis requirement, but it is a reason to create a reporting framework in which different companies can be compared with one another. This consistency is what the SEC rule would help achieve.

By its very nature, scenario analysis is forward-looking. It uses historical data, but the technique uses imagination and with story-telling to break away from linear thinking.

Page 86

We are not, however, proposing to mandate that registrants conduct scenario analysis . . . in certain instances, it may be costly or difficult for some registrants to conduct such scenario analysis. Instead, the proposed rules would require that if a registrant uses scenario analysis or any analytical tools to assess the impact of climate-related risks on its business and consolidated financial statements, and to support the resilience of its strategy and business model, the registrant must disclose certain information about such analysis.

This section is self-explanatory.

Reality

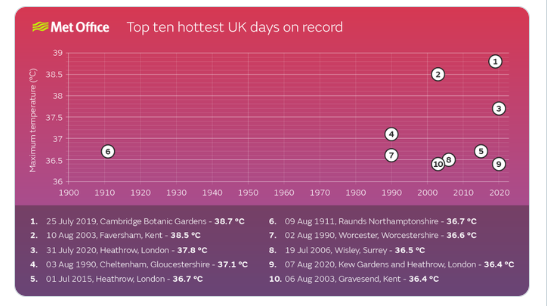

The SEC rule is lengthy (490 pages) and can be difficult to follow. It is important never to forget that the rule is to do with real world issues. Just this week, for example, many parts of Europe are experiencing unprecedented temperatures and wild fires. The SEC rule matters.

The chart shows that seven of the top ten hottest days in the UK have occurred since the year 2000.

Previous Posts in this Series

We will continue this analysis of the scenario analysis requirements of the SEC rule in future posts. Earlier posts are: